A specialist in insurance and risk management acts on behalf of his clients and provides advice in their interest

Founded in 1999, JTD is a well-established independent insurance broker providing its tailored services to companies, public authorities and affluent private clients in Italy.

A full-service, boutique insurance broker that has been taking insurance to the next level for its clients since day one. Offering a complete range of products and services, JTD specializes in addressing the needs

of mid- to large-cap companies and high-net-worth individuals and their families.

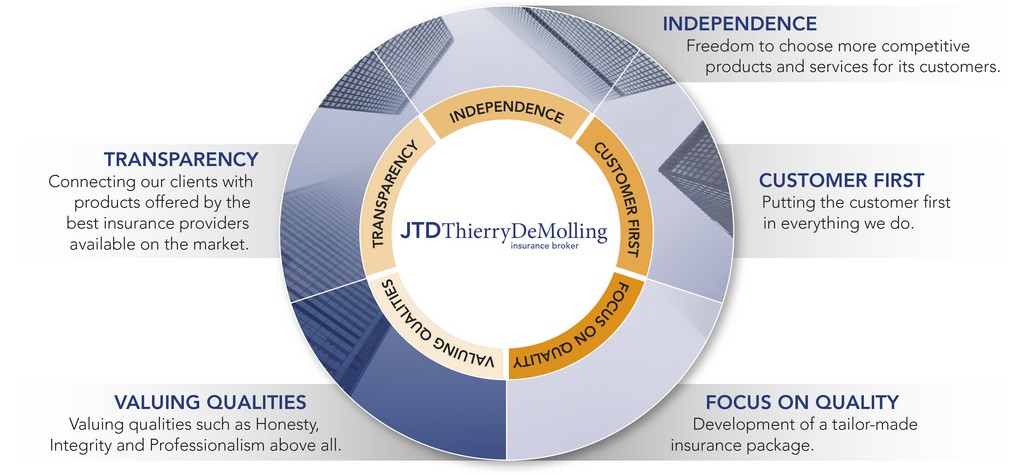

INDEPENDENCE

Freedom to choose more competitive products and services for its customers.

TRANSPARENCY

Connecting our clients with products offered by the best insurance providers available on the market.

CUSTOMER FIRST

Putting the customer first in everything we do.

VALUING QUALITIES

Valuing qualities such as Honesty, Integrity and Professionalism above all.

FOCUS ON QUALITY

Development of a tailor-made insurance package.

Our Process

Why Choose Us

Thanks to its technical and legal knowledge and to the quality of its services in the territory, JTD will support the company for:

Risks assessment or a systematic process of evaluating the potential risks that may be involved in a projected activity or undertaking.

Local integration of insurance not taken over from Head office, advising the client on the local insurance requirements.

Employee benefits programs, i.e. benefits other than wages or salary, provided by employer for employees (e.g., health, dental, life, disability, retirement, long term care).

Annual reports of management (summary – budgets – laws and regulations – fiscal aspects).

Claims management for the processing and settlement of claims.

Loss control activity focusing on reducing the severity of losses (e.g. building firewalls to reduce the spread of fire and installing automatic fire sprinklers).

Coordination or trilateral communication between local customer, insurer and head office customer or its broker (for multinational accounts).

Due Diligence studies for M&A

Line of Business

JTD offers companies the major forms of insurance giving details of different products in the market.

Risks in industrial or commercial activity concern:

• Protection of assets (property, operating losses) • Business Interruption (fire, machinery breakdown, computer) •

• Protection of people (employees, expatriates, staff on duty) • Liability (civil, products, administrators, environment) •

• Legal protection • Credit, guarantees, contractual guarantees • Transport of goods •

• Cyber Risks • Travel

On Demand

The concept “on demand” allows, for example, to create program agreements for:

• Employees (benefit packages …) • External (benefits for consultants, interns, agents) •

• Special programs for “Add-on” insurance associated with a primary product •

• Events insurance (Liability, Cancellation)

![]()

Via Aristide De Togni, 1 • 20123 Milan (Italy) • Phone +39 02 48 01 91 34 • Fax +39 02 48 01 91 38 • Mobile +39 335 808 71 55

E-mail: jtd@jtdbroker.com • jtd@pec.it • R.U.I. B000119357 • A.I.B.A. member (Italian broker association).